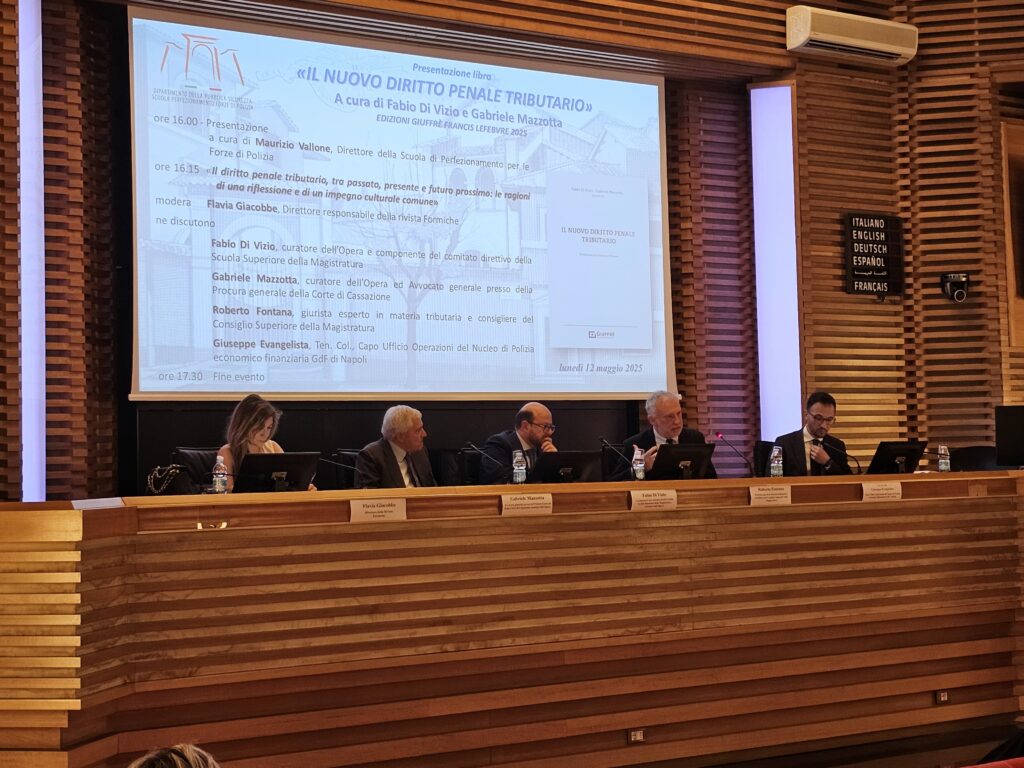

In the afternoon of 12 May 2025, the presentation of the book Il nuovo diritto penale tributario (The new Tax Criminal Law), edited by Mr. Fabio Di Vizio and Mr. Gabriele Mazzotta, published by Giuffrè Francis Lefebvre, was held at the “Prefetto Carlo Mosca” Conference Hall at the Scuola di Perfezionamento per le Forze di Polizia.

This event, which proved to be an important opportunity to analyze in details the regulatory and jurisprudential developments of Tax Criminal Law, was attended by the trainers of the 40th Advanced Training Course as well as of the 30th II Level Crime Analysis Course.

The meeting, which was introduced by the welcome address delivered by National Police Dirigente Generale Maurizio Vallone, Director of the Scuola di Perfezionamento per le Forze di Polizia, was moderated by Mrs. Flavia Giacobbe, Editor-in-chief of the magazine Formiche. During the presentation, a discussion was held among some of the main experts in this field, who addressed in details the challenges and opportunities that Tax Criminal Law has to deal with.

The editors of the book, Mr. Fabio Di Vizio, magistrate and member of the Steering Committee of the Scuola Superiore della Magistratura and Mr. Gabriele Mazzotta, Attorney General at the General Prosecutor’s Office of the Court of Cassation, delivered their lectures. The other lecturers were Mr. Roberto Fontana, Councilor of the Superior Council of the Judiciary and tax law jurist, and Mr. Giuseppe Evangelista, Lieutenant Colonel of the Guardia di Finanza Corps and Head of the Operations Office of the Economic-Financial Police Unit of Naples.

The debate highlighted the urgency of a constant updating of the regulatory and cultural tools available to legal practitioners, in a regulatory context that is rapidly changing and that requires increasingly targeted preparation. In particular, the need emerged to address the challenges related to the effectiveness of tax justice, thus improving the synergy between the various actors involved, from legal institutions to police forces, as well as the experts in this field.

The event concluded with a wide participation and a lively discussion, thus further underlying the importance of this book, which is considered to be a tool to be used by all the practitioners working in the field of Tax Criminal Law for their refresher activity and in-depth analysis.